Money isn’t just about bills or retirement it’s about having choices. True wealth is measured not in things, but in the power to walk away, shape your destiny, and live life on your terms.

Your FU Number ("Financially Unattached Money") is that magic sum a fund built for freedom. It isn’t an emergency stash or retirement plan. It’s your “present-day” freedom reserve a negotiation tool, not a parachute.

What Is an FU Number?

Think of the FU Number as your financial exit key. It gives you the right to:

- Walk out of a toxic job, stress-free.

- Hit pause and enjoy a real break no guilt, no fear.

- Dive into a startup, side project, or sabbatical with full autonomy.

- Set boundaries and say “No” to anything that doesn’t align with your vision.

“The FU Number isn’t about arrogance it’s about peace of mind.”

Quick-Math Thumb Rule

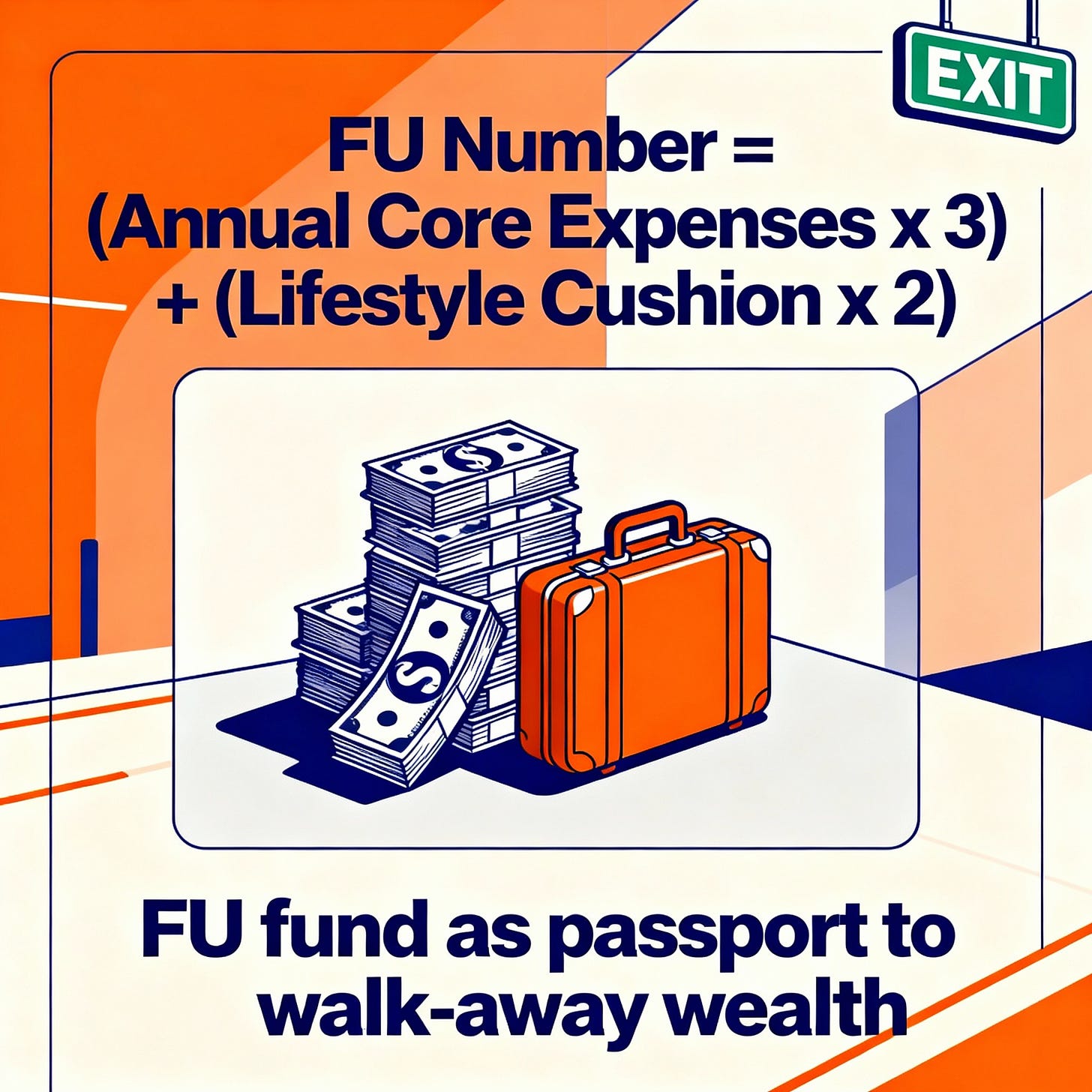

A simple, actionable formula:

FU Number = (Annual Core Expenses x 3 times ) + (Lifestyle Cushion x 2 times)

- Annual Core Expenses: Cover the essentials housing, food, utilities, healthcare.

- ×3: Three years’ buffer gives space for career pivots and reflection.

- Lifestyle Cushion: One year’s enjoyment and flexibility budget.

- ×2: Extra room for those “life happens” moments.

Sample Calculation:

- Core expenses: ₹18 lakh ($22,000)

- Lifestyle cushion: ₹6 lakh ($7,000)

FU = (18 x 3) + (6 x 2) = 54 + 12 = ₹66 lakh ($80,000)

“Your FU Number is not about living rich it’s about living free.”

Regional Reality Check

In India’s Tier-1 cities, core living costs generally hover around $20,000 a year, meaning the typical FU Fund range is $60,000 to $90,000.

In Southeast Asia for an expat lifestyle, $25,000 per year is a fair core living estimate, with FU ranges from $75,000 to $110,000.

For major cities in Western Europe, expect core living costs near $45,000 a year and FU ranges between $135,000 and $200,000.

A coastal U.S. city like New York or San Francisco often needs $55,000 per year for core living, setting the FU Fund target at $165,000 to $250,000. For a mid-cost U.S. city, core living could be about $35,000 annually, so FU Numbers run from $105,000 to $160,000.

Adjust upward if you have a family, children, or significant health costs. Reduce if you’re especially frugal or location-independent.

Why Bother Building an FU Fund?

- Pursue Passions: Secure the time to create, tinker, or learn on your clock, not your boss’s.

- Collect Experiences: Travel, rest, or relocate without tracking paid leave.

- Play Offense: Take risk-on moves (startups, investing, moving cities) with survival never in question.

“Survival is defense. FU Money lets you play offense.”

🧠 The Psychological Edge

This isn’t just a “stash”—it’s psychological armor. The FU Fund gives you courage capital. You don’t burn your ships, you “own” them, ready to sail at will.

- “Feather your nest”—Comfort is built before it’s needed.

- “Money talks, wealth whispers”—Real security is quiet and powerful.

- “Dig the well before you’re thirsty”—Start before crisis strikes.

🛠️ Action Path

1. Audit Your Life: Know your real annual costs—essentials and fun.

2. Automate Savings: Funnel 20%–40% of income straight into a separate, sacred FU account.

3. Invest Wisely: Opt for liquid, low-volatility assets index funds, short-term bonds, or high-yield savings.

4. Stay Disciplined: No impulse withdrawals. This fund is your foundation, not a windfall.

💡 Bottom Line

Your FU Number isn’t about luxury, it’s about “leverage”.

It’s not saying “no” to money it’s saying “yes” to yourself.