A Data-Driven Perspective on Affordability, Returns, and Social Pressures

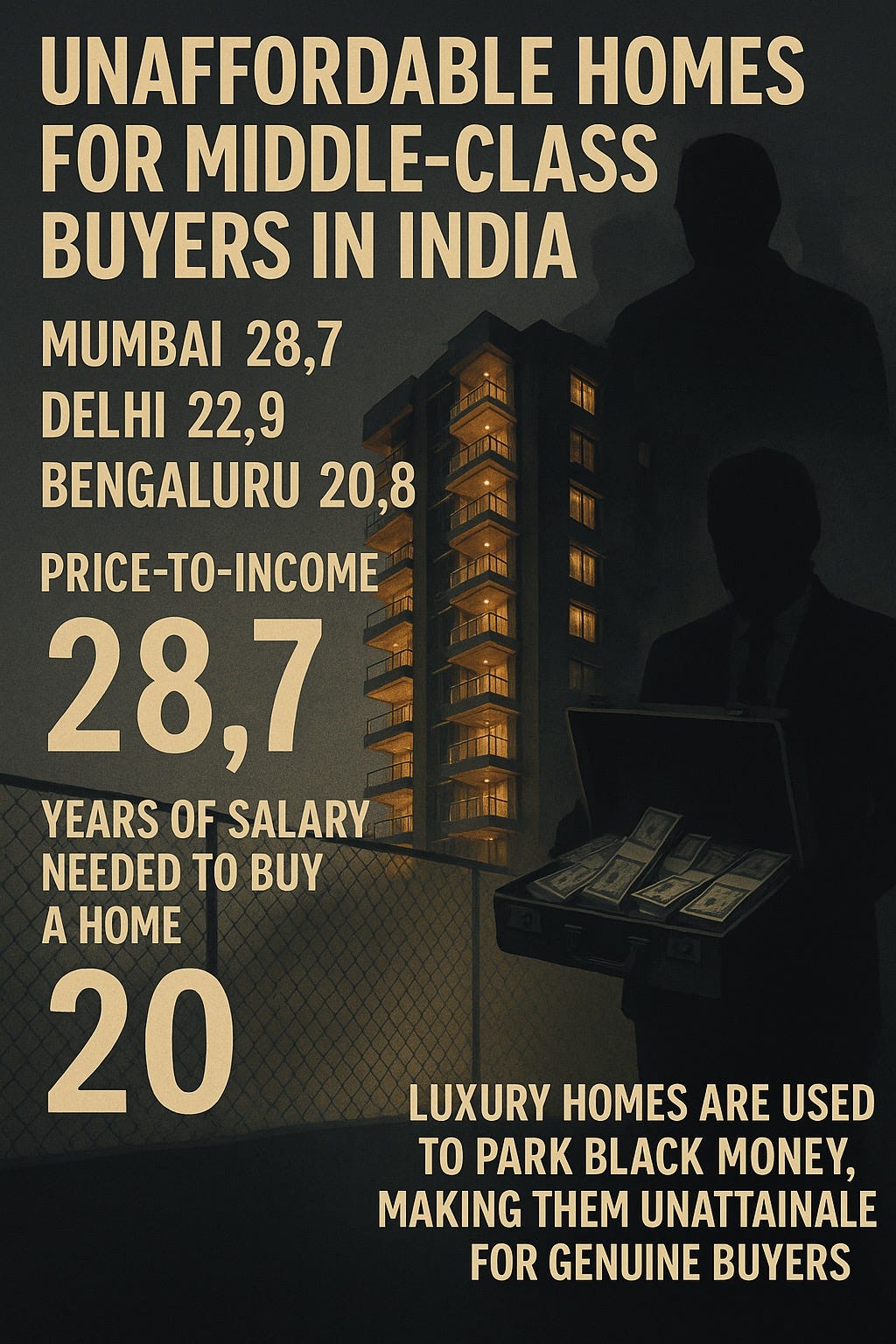

India’s urban housing market is at a crossroads: prices are at record highs, while real incomes and social mobility stagnate. This deep-dive examines affordability, investment returns, and the social and cultural forces that drive millions to buy homes—often at great personal and financial risk. Each city chapter includes detailed salary data (individual, couple, top 1%), years to buy, XIRR, rental yields, and global comparisons, plus a candid look at the pros and cons of buying in today’s market.

Chapter 1: Mumbai

Avg. 2BHK Price (2025): ₹1.26 crore (₹12,600/sq ft)12

Avg. Individual Salary: ₹9,00,000/year3

Avg. Couple Salary: ₹18,00,000/year

Top 1% Salary: ₹60,00,000+/year4

Years to Buy (Individual/Couple/Top 1%): 14 / 7 / 2

10-Year XIRR: ~6.7%5

Rental Yield: 4.05% (up from 3.5% in 2019)6

Price-to-Income Ratio: 28.47

Global Comparison: New York (6), London (18.6), Berlin (7)7

Social/Parental Pressure: Extremely high—owning a home is seen as a status symbol, a rite of passage, and a family legacy. 80% of buyers intend to pass on property to children7. Peer FOMO is rampant, and “rent is wasted money” is a common refrain8791011.

Analysis: Despite a recent moderation in price growth, Mumbai remains India’s least affordable city. Even dual-income professionals face a 7-year gross income hurdle; for the average worker, it’s a lifetime. Most buyers rely on family wealth, inheritance, or undisclosed funds. In contrast, a similar home in New York or Berlin is 3–5x more affordable relative to income753.

Chapter 2: Delhi NCR

Avg. 2BHK Price: ₹81 lakh (₹8,105/sq ft)12

Avg. Individual Salary: ₹2.5–3 lakh/year (median)12

Avg. Couple Salary: ₹5–6 lakh/year

Top 1% Salary: ₹30,00,000+/year

Years to Buy (Individual/Couple/Top 1%): 32 / 16 / 3

10-Year XIRR: ~5.2%5

Rental Yield: 2.8% (up from 2.2% in 2019)6

Price-to-Income Ratio: 327

Global Comparison: Chicago (4), Manchester (6)

Social/Parental Pressure: Intense, especially in joint families. “Apna ghar” is a must for marriage and status. Parents often push children to buy early, fearing missed opportunities871011.

Analysis: Delhi’s average salary is skewed by a small elite; for most, homeownership is out of reach. Black money and cash deals are rampant, with frequent IT raids exposing hundreds of crores in unaccounted cash7. Even top 1% earners face a multi-year commitment, while global peers in Chicago or Manchester buy in a fraction of the time7125.

Chapter 3: Bengaluru

Avg. 2BHK Price: ₹75 lakh (₹7,536/sq ft)12

Avg. Individual Salary: ₹4,13,900/year9

Avg. Couple Salary: ₹8,27,800/year

Top 1% Salary: ₹25,00,000+/year

Years to Buy (Individual/Couple/Top 1%): 18 / 9 / 3

5-Year Price Growth: +79% (highest among metros)2

10-Year XIRR: 8.98% (highest among metros)5

Rental Yield: 4.35% (up from 3.6% in 2019)6

Price-to-Income Ratio: 187

Global Comparison: Austin (5), Prague (17.4)

Social/Parental Pressure: High among tech professionals, driven by peer success, FOMO, and belief in perpetual appreciation. Parental advice often encourages early purchase871011.

Analysis: Bengaluru’s tech boom has driven prices up 79% in five years—far outpacing wage growth2. While rental yields and XIRR are higher than other metros, affordability remains a challenge for most, with only the top 1% able to buy comfortably. In Austin or Prague, a similar home is much more accessible2597.

Chapter 4: Hyderabad

Avg. 2BHK Price: ₹70 lakh (₹7,053/sq ft)12

Avg. Individual Salary: ₹4,47,700/year6

Avg. Couple Salary: ₹8,95,400/year

Top 1% Salary: ₹20,00,000+/year

Years to Buy (Individual/Couple/Top 1%): 16 / 8 / 3.5

5-Year Price Growth: +43%2

10-Year XIRR: ~5%5

Rental Yield: 3.7% (up from 3.4% in 2019)13

Price-to-Income Ratio: 167

Global Comparison: Dallas (4)

Social/Parental Pressure: Strong, especially for families with children. Community and school proximity are key factors71410.

Analysis: Hyderabad’s rapid price growth has made even “affordable” homes a decade-long savings goal for most. The market is split between genuine buyers and speculative investors, with social and parental pressure pushing many into large EMIs1514135.

Chapter 5: Pune

Avg. 2BHK Price: ₹71 lakh (₹7,108/sq ft)12

Avg. Individual Salary: ₹4,07,300/year10

Avg. Couple Salary: ₹8,14,600/year

Top 1% Salary: ₹20,00,000+/year

Years to Buy (Individual/Couple/Top 1%): 17 / 8.7 / 3.5

5-Year Price Growth: +18%2

10-Year XIRR: ~7–8%5

Rental Yield: 3.75% (up from 3.3% in 2019)6

Price-to-Income Ratio: 177

Global Comparison: Warsaw (7)

Social/Parental Pressure: High, with strong emphasis on “settling down” early71011.

Analysis: Pune’s IT and manufacturing growth has pushed prices up, but wage growth has lagged. While returns are slightly better than other metros, the affordability gap persists. In Warsaw, a similar home is far more accessible to average earners25107.

Chapter 6: Chennai

Avg. 2BHK Price: ₹72 lakh (₹7,173/sq ft)12

Avg. Individual Salary: ₹4,06,800/year11

Avg. Couple Salary: ₹8,13,600/year

Top 1% Salary: ₹18,00,000+/year

Years to Buy (Individual/Couple/Top 1%): 18 / 9 / 4

5-Year Price Growth: +25%2

10-Year XIRR: 7.53%5

Rental Yield: 3.66%16

Price-to-Income Ratio: 187

Global Comparison: Manchester (6)

Social/Parental Pressure: Deeply rooted in tradition. Vastu, auspicious timing, and family advice are major influences71011.

Analysis: Chennai’s steady price growth has not translated into greater affordability. Social and parental expectations remain high, but the financial logic often points toward renting, as in Manchester or other global cities25117.

Chapter 7: Kolkata

Avg. 2BHK Price: ₹56 lakh (₹5,633/sq ft)12

Avg. Individual Salary: ₹4,21,200/year

Avg. Couple Salary: ₹8,42,400/year

Top 1% Salary: ₹15,00,000+/year

Years to Buy (Individual/Couple/Top 1%): 13 / 6.6 / 3.7

5-Year Price Growth: +29%2

10-Year XIRR: 5.99%5

Rental Yield: 5.03%16

Price-to-Income Ratio: 137

Global Comparison: Budapest (8)

Social/Parental Pressure: High, but many young professionals now prefer renting due to stagnant job growth71011.

Analysis: Kolkata’s price jump has eroded affordability, despite lower nominal prices. The market is still culturally driven, with property viewed as a family legacy. In Budapest, the price-to-income ratio is far lower, making ownership more realistic257.

Chapter 8: Ahmedabad

Avg. 2BHK Price: ₹44 lakh (₹4,402/sq ft)12

Avg. Individual Salary: ₹4,00,000/year

Avg. Couple Salary: ₹8,00,000/year

Top 1% Salary: ₹15,00,000+/year

Years to Buy (Individual/Couple/Top 1%): 11 / 5.5 / 2.9

5-Year Price Growth: +15%2

10-Year XIRR: ~6%5

Rental Yield: 4.2% (up from 3.6% in 2024)13

Price-to-Income Ratio: 117

Global Comparison: Dallas (4)

Social/Parental Pressure: Moderate; homeownership is still seen as a sign of stability and respectability71011.

Analysis: Ahmedabad is more affordable than other metros, but even here, a basic home costs over a decade’s salary. Rental yields are improving, but global benchmarks remain far more favorable for buyers25137.

Chapter 9: Thane & Navi Mumbai

Avg. 2BHK Price: ₹1.32 crore (₹13,197/sq ft)12

Avg. Salary: Similar to Mumbai

Years to Buy (Individual/Couple/Top 1%): 14–15 / 7–7.5 / 2.2

5-Year Price Growth: +23% (Thane), +13% (Navi Mumbai)2

Rental Yield: 3.15–3.35%6

Price-to-Income Ratio: 147

Global Comparison: Berlin (7)

Social/Parental Pressure: High, with strong family and peer influence on buying decisions71011.

Analysis: Prices in these satellite cities now rival Mumbai, and affordability remains a challenge for most. Rental yields have improved, but not enough to justify the high entry cost compared to global peers2567.

Chapter 10: Social and Cultural Pressures—The Invisible Hand

Parental Advice: 80% of Indian parents urge children to buy a home as soon as possible, often citing legacy, security, and fear of future price hikes711.

Peer Pressure: FOMO is widespread, with friends and colleagues’ purchases driving others to buy—sometimes at peak prices2.

Renting Stigma: Renting is still seen as “wasting money,” despite lower costs, flexibility, and fewer risks891011.

Children’s Needs: School proximity, amenities, and “good locality” drive families toward larger, costlier homes1410.

Assumptions About Investment: Many believe property is always a good investment, despite XIRRs of 5–9%—lower than equities and many global housing markets51718.

Chapter 11: Investment Returns—XIRR, Rental Yields, and Risks

10-Year XIRR: 5–9% in most metros, with Bengaluru at the top (8.98%)52.

Global Comparison: US, UK, and EU cities offer similar or better yields with lower price-to-income ratios and higher liquidity75.

Risks: Project delays, legal disputes, low liquidity, and high concentration risk are common in India1718.

Alternative Investments: Equity mutual funds have returned 12–15% over the same period, with greater liquidity and diversification17.

Chapter 12: Pros and Cons of Buying in India’s Top Cities

Pros:

Potential for capital appreciation in select micro-markets518.

Hedge against rent inflation and forced moves.

Customization and control over living space.

Cons:

Affordability Crisis: Most individuals and couples face 10–30 years of income to buy a modest home1231291011.

Low Returns: XIRR and rental yields are low compared to equities and global property markets51718.

High Risk: Project delays, legal issues, and illiquidity are common1718.

Social Pressure: Family and peer expectations can push buyers into risky financial decisions871011.

Renting Stigma: Renting is often a better financial choice but remains culturally stigmatized891011.

Concentration Risk: Most buyers put a large share of their net worth into a single, illiquid asset17.

Conclusion

Despite powerful social, parental, and peer pressures, the numbers are clear: for the average Indian, homeownership in top cities is increasingly unaffordable and often a suboptimal investment. Returns are modest, risks are high, and cultural beliefs—while emotionally compelling—can lead to poor financial outcomes. Until transparency, affordability, and rational investment logic prevail, the “ownership dream” will remain elusive for most, even as luxury towers rise on the skyline.

How Investment Trends Influence the Long-Term Value of Real Estate in India’s Top Cities

1. Speculative Investment and Black Money

Investment trends in India’s major cities are heavily influenced by speculative buying and the influx of black money. Real estate has long served as a preferred avenue for parking undeclared wealth, leading to a parallel market where prices are set not by genuine demand but by the ability to pay large sums in cash. This trend artificially inflates property values, making homes unaffordable for average, salaried buyers and creating a disconnect between real income levels and property prices.

Luxury Segment Boom: High-end projects with premium amenities are designed to attract cash-rich investors, not genuine residents. This demand from speculative and black-money buyers keeps prices elevated, even when local incomes do not justify such valuations.

Vacant Inventory: Over 10 million homes lie empty across India, bought as investments or for laundering money rather than for living, further distorting supply-demand dynamics.

2. Impact of Investment Returns and Yields

XIRR and Rental Yields: Over the past decade, the annualized returns (XIRR) on residential real estate in top Indian cities have ranged from 5% to 9%, with Bengaluru at the higher end (nearly 9%). Rental yields remain low, typically 2.5–4% in most metros, compared to 7–8% in select micro-markets. These returns are modest relative to equity mutual funds, which have delivered 12–15% over the same period.

Global Comparison: Price-to-income ratios in Indian metros (e.g., Mumbai at 28.4, Delhi NCR at 32) are among the highest globally, making Indian real estate far less affordable than in cities like New York, Chicago, or Berlin, where ratios are much lower and yields often higher.

3. Influence of Builder Lobby and Regulatory Capture

Policy Shaping: Builders’ associations and the developer-politician nexus have significant influence over regulations, often slowing or shaping reforms to protect their interests. This regulatory capture leads to uneven enforcement of laws like RERA, allowing opaque practices and under-the-table deals to persist.

Corruption and Costs: Developers routinely factor bribes for project approvals into prices, adding 30–40% to the final cost of an apartment. These extra costs are ultimately borne by buyers, further raising entry barriers for genuine home seekers.

4. Investment Trends and Market Cycles

Speculative Cycles: Investment-driven booms can lead to sharp price surges, as seen in Bengaluru (+79% in five years) and Hyderabad (+43%). However, these cycles also bring risk: prolonged periods of stagnation or correction can erode returns, especially for those who bought at peak prices.

Liquidity Risk: Real estate is an illiquid asset. During downturns or regulatory crackdowns (e.g., on black money), it can be difficult to sell properties quickly or at expected prices, increasing long-term risk for investors.

5. Social and Cultural Investment Drivers

Social Pressure: Cultural norms, parental advice, and peer influence drive many Indians to buy homes as soon as possible, often at the cost of financial prudence. The belief that real estate is always a “safe” or “best” investment persists, even when data suggests otherwise.

Renting Stigma: Renting is often stigmatized as “wasting money,” pushing more people into home purchases, which sustains demand and keeps prices high—regardless of underlying investment value.

6. Regulatory and Technological Shifts

Digitization and Transparency: Recent government initiatives, such as the Digital India Land Records Modernization Programme and the Registration Bill 2025, aim to digitize land records and transaction histories. These reforms, if fully implemented, could curb black money flows and speculative investment, potentially leading to more rational pricing and improved long-term value for genuine buyers.

Taxation and Asset Allocation: Changes in tax rules (e.g., for debt mutual funds) also influence where investors allocate capital. When real estate becomes less attractive relative to other asset classes, it can slow price growth or even trigger corrections

Investment trends—especially speculative buying, black money inflows, and cultural biases—have kept property prices in India’s top cities elevated well beyond what local incomes can support. While these trends have delivered moderate returns for some, they have also introduced volatility, liquidity risk, and widespread unaffordability. Only robust regulatory reforms, digitization, and a shift toward transparency can ensure that long-term real estate values reflect genuine demand and sustainable investment, rather than short-term speculation or opaque practices

https://www.globalpropertyguide.com/asia/india/price-history

https://squarefeatindia.com/rooted-in-realty-why-indians-still-put-their-heart-into-homeownership/

https://www.globalpropertyguide.com/asia/india/rental-yields

https://epicinfrateck.com/benefits-of-homeownership-in-india-is-it-the-right-time-to-buy-2024/

https://www.gandhinagarproperty.com/blog/rent-or-buy-in-2025-which-living-option-is-right-for-you

https://snehilyadav.com/2025/04/24/india-and-its-propety-dilemma/

https://www.99acres.com/articles/top-tier-ii-cities-to-invest.html

https://thedailybrief.zerodha.com/p/is-it-getting-harder-to-afford-a

https://www.housepecker.com/blog-details/home-loan-pros-and-cons-in-india-complete-guide-2025

https://zolostays.com/blog/what-is-cost-of-living-in-mumbai/

https://www.bajajfinserv.in/know-about-property-rates-mumbai

https://dwello.in/news/six-things-parents-should-consider-before-buying-a-residential-property

https://pharandespaces.com/blog/best-cities-for-real-estate-investment-in-india/

https://www.jll.com/en-in/newsroom/rate-cuts-expected-to-optimize-home-affordability-in-2025

https://worldpopulationreview.com/country-rankings/affordable-housing-by-country

https://idronline.org/article/rights/fostering-an-inclusive-property-rights-landscape/